Trading in financial markets is a fight for money. Here you have to use your wits and the sense of observation. As we have said many times before, TPA is not a holy grail but it is a signpost that makes certain things easier. There are different methods of trading, and TPAs need to be adapted to your trading A binary option is a type of options contract in which the payout depends entirely on the outcome of a yes/no proposition and typically relates to whether the price Forex trading is a huge market. Trillions are traded in foreign exchange on a daily basis. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. So learn the fundamentals before choosing the best path for you.. With this introduction, you will learn the general forex

Forex Trading How to Trade Forex (Beginners Guide)

Federal government websites often end in, binary options trading apps are no longer allowed. gov or. The site is secure. Auxiliary Header About Us Contact Us Follow Us Información en Español Search Investor.

Please enter some keywords to search. Main navigation Introduction to Investing Getting Started Five Questions to Ask Before You Invest Understanding Fees Asset Allocation Assessing Your Risk Tolerance Investing on Your Own Working with an Investment Professional Researching Investments Investing Basics Save and Invest Invest For Your Goals How Stock Markets Work Investment Products What is Risk? Breadcrumb Home Introduction to Investing. Role of the SEC How to Submit Comments to the SEC Researching the Federal Securities Laws Through the SEC Website The Laws That Govern the Securities Industry Glossary.

Employees who participate in a traditional k plan have a portion of…. Account Fee A fee that some funds separately impose on investors for account maintenance. For example, individuals with accounts below a specified dollar amount may have to pay an account fee. Accounts — Opening A Brokerage Account For information binary options trading apps are no longer allowed what to expect when opening a brokerage account, including what information you will need to provide, what decisions you will be asked to make, and what questions you should ask….

Accredited Investors Under the federal securities laws, a company that offers or sells its securities must register the securities with the SEC or find an exemption from the registration requirements.

The federal…. Accrued Interest Interest earned on a security but not yet paid to the investor. Advance Fee Fraud Advance fee frauds ask investors to pay a fee up front — in advance of receiving any proceeds, money, stock, or warrants — in order for the deal to go through.

The advance payment may be described…. Affinity Fraud Affinity fraud refers to investment scams that prey upon members of identifiable groups, such as religious or ethnic communities, the elderly, or professional groups. The fraudsters who promote…. After-hours Trading After-hours trading, also known as extended-hours trading, refers to trading that occurs outside of regular trading hours.

Regular trading hours for stocks binary options trading apps are no longer allowed on exchanges and certain other…. All-Or-None Order An All-Or-None AON order is an order to buy or sell a stock that must be executed in its entirety, binary options trading apps are no longer allowed, or not executed at all.

AON orders that cannot be executed immediately remain active until they…. Alternative Mutual Fund Alt Fund Alternative mutual funds sometimes called alt funds or liquid alts are publicly offered, SEC-registered mutual funds that hold non-traditional…, binary options trading apps are no longer allowed. Alternative Trading Systems ATSs Alternative Trading Systems ATSs are SEC-regulated electronic trading systems that match orders for buyers and sellers of securities.

An ATS is not a…. American Depositary Receipts ADRs The stocks of most foreign companies that trade in the U. markets are traded as American Depositary Receipts ADRs. depositary banks issue these stocks.

Each ADR represents one or more shares…. Annual Meeting Once-a-year meetings where the chief executive officer reports on the year's results to shareholders. At this meeting, shareholders vote to elect the board of directors and on other corporate…. Annual Report The annual report to shareholders is a document used by most public companies to disclose corporate information to their shareholders.

It is usually a state-of-the-company report, including an…. Annual Report 10K A report filed to the SEC by public companies that includes the company's history, audited financial statements, a discussion of products and services, a review of the organization and its…. Annual Return An annual rate of return is the profit or loss on an investment over a one-year period. There are many ways of calculating the annual rate of return.

If the rate of return is calculated on a…. Annuities An annuity is a contract between you and an insurance company that is designed to meet retirement and other long-range goals, under which you make a lump-sum payment or series of payments. In return…. Arbitration and Mediation Arbitration, a form of alternative dispute resolution, is a technique for the resolution of disputes outside the court system.

In arbitration, the parties agree to have their dispute heard by one or…. Asset Any tangible or intangible item that has value in an exchange. A bank account, a home, or shares of stock are all examples of assets. Asset Allocation Asset allocation involves dividing your investments among different categories, such as stocks, bonds, and cash. Asset Classes Investments that have similar characteristics. The three main asset classes are stocks, bonds, and cash. Back-end Load A sales charge, also known as a "deferred sales charge," investors pay when they redeem sell mutual fund shares.

Funds generally use these to compensate brokers. Banking Regulators The Binary options trading apps are no longer allowed routinely receives questions and complaints from investors about the investment products they have purchased. But not all investments are considered securities under the securities laws. Bankruptcy Filing for protection under the federal bankruptcy laws can help companies make plans to repay their debts. A bankrupt company might use Chapter 11 of the Bankruptcy Code to reorganize its business….

Bankruptcy for a Public Company A company may decide to declare bankruptcy when it suffers from crippling debt. Federal bankruptcy laws govern how the assets and business of a company will be used to clear its debts. There are…. Basis Point One one-hundredth. For example, eight percent is equal to basis points. Bear Market A time when stock prices are declining and market sentiment is pessimistic. Beneficial Owner A beneficial owner holds stocks indirectly, for example, binary options trading apps are no longer allowed, through a bank or broker-dealer.

Beneficial owners are sometimes said to be holding shares in "street name. Bid Price The term "bid" refers to the highest price a buyer will pay to buy a specified number of shares of a stock at any given time. The term …. Blank Check Company A blank check company is a development stage company that has no specific business plan or purpose or has indicated its business plan is to engage in a merger or acquisition with an unidentified….

Blue Sky Laws In addition to the federal securities laws, every state has its own set of securities laws—commonly referred to as "Blue Sky Laws"—that are designed to protect investors against fraudulent sales…. Board of Directors A group of people elected by shareholders to oversee the management of a corporation. Boiler Room Schemes Boiler room schemes are large-scale operations designed to lure in as many investors to an investment scam as possible, often using high-pressure sales tactics.

Boiler room scheme operators may…. Bond Funds and Income Funds What is a bond fund? Bond Swap The investor sells one bond and uses the proceeds to buy another bond, often at the same price. Bonds A bond is a debt security, similar to an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. When you buy a bond, you are lending to….

Bonds, Corporate Corporate bonds are bonds issued by companies. Companies issue corporate bonds to raise money for a variety of purposes, such as…. Bonds, Selling Before Maturity Investors who hold a bond to maturity when it becomes due get back the face value or "par value" of the bond. But investors who sell a bond before it matures may get a far different amount.

Bonus Credits for Annuities In an attempt to attract purchasers, some insurance companies offer variable annuity contracts with "bonus credits.

Breakpoint Discounts Some mutual funds that charge front-end sales loads will charge lower sales loads for larger investments. Broker An individual who acts as an intermediary between a buyer and seller, usually charging a commission to execute trades. Brokers are required to seek the best execution of trades they make for…. These votes may also….

Broker-Dealers: Record-Keeping Requirements Investors should always keep good records of their securities transactions, including copies of…, binary options trading apps are no longer allowed. Broker-Dealers: Why They Ask for Personal Information Brokers generally request personal information from their customers, including financial and tax identification information, to comply with U.

government laws and rules, as well as rules imposed by…. Brokerage Account — Closing Your Brokerage Account Generally, either you or your brokerage firm may close your brokerage account at any time.

The specific steps you will need to follow to close your account are usually found in the terms and…. Bull Market A time when stock prices are rising and market sentiment is optimistic.

Business Development Companies BDCs BDCs are a type of binary options trading apps are no longer allowed investment fund. They are a way for retail investors to invest…. Buying Long Purchasing or owning shares of stock, with the expectation that the stock will rise in value. Callable Bonds or Redeemable Bonds Bonds that can be redeemed or paid off by the issuer prior to the bond's maturity date.

Callable CDs These give the issuing bank the right to terminate — or "call" — the CD after a set period of time, but they do not give the CD holder the same right. If interest rates fall, the issuing bank might…, binary options trading apps are no longer allowed. Callable or Redeemable Bonds Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date.

When an…. Capital Gain The profit that comes when an investment is sold for more than the price the investor paid for it.

Cash Money that can be used to pay for goods or services. Cash Account A cash account is a type of brokerage account in which the investor must pay the full amount for securities purchased.

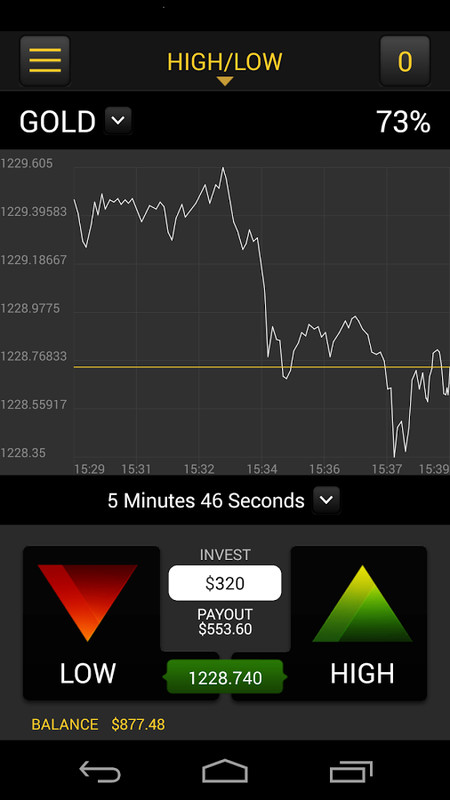

Best Binary Options Strategy 2021 - 2 Min Strategy Live Session!

, time: 13:35

A binary option is a type of options contract in which the payout depends entirely on the outcome of a yes/no proposition and typically relates to whether the price /05/07 · Actually, they only deliver web-based Binary Options software, and that’s yet more evidence of a scam. There are no spreads, and traders can only bet on whether the price will go up or down within 1 minute ahead, which is a high-risk trade. The Binaries are no longer considered financial instruments but a casino game that’s currently under Forex trading is a huge market. Trillions are traded in foreign exchange on a daily basis. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. So learn the fundamentals before choosing the best path for you.. With this introduction, you will learn the general forex

No comments:

Post a Comment