A crucial consideration in forex taxation is the difference between long-term and short-term capital gains, as defined by the IRS. In general, long-term gains are those realized on investments held longer than a year; you take short-term gains (or losses) on investments that you hold for less than a year 3/29/ · Forex traders found liable to personal taxation on their trading profits in the U.K. are taxed on the basis of their applicable income tax rates or capital gains tax. Interest payments and profits from trading when conducted as a business are likely to be subject to income tax (from 20% to 45%), while other taxable profits are generally taxed as a capital gain (at 10% or 20%).Estimated Reading Time: 3 mins 3/13/ · In the U.S., many forex brokers do not handle your taxes. This means that it’s up to you to compute your gains and losses and file your dues or deductions with the appropriate tax authorities. I know it’s difficult, so I decided to put together a mini-primer on how Forex trading taxes work as I Author: Forex Ninja

How Is FOREX Taxed? | Budgeting Money - The Nest

Reading Time: minutes. This post is also available in: Indonesia. Forex is a truly gigantic financial market — the largest in the world! Its size, turnover over 6 trillion US dollarsand liquidity attract millions of people around the globe. Unfortunately, some of them overlook the long-term implications of fx buying and selling. In some countries, Forex traders have to pay taxes in accordance with the local legislation. So, where is Forex trading taxed?

Here is an overview of the main intricacies and regional differences connected to the taxing of FX trades. Is Forex trading taxed where you live? How much you pay will depend on your country of residence.

It is essential to see if taxation applies to your fx gains or losses before becoming actively involved in the market. This is an important aspect of Forex for beginners — learn more from our comprehensive guide.

So, how much exactly do Forex traders pay? For example, compare the situation for brokers based in the US and the UK.

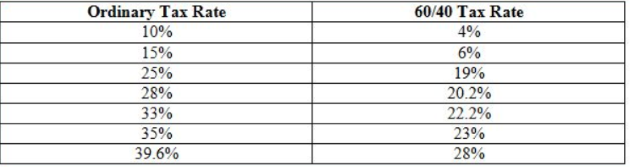

Their conditions are very different. The US has a stringent system of regulations. The amount of capital gains tax is defined based on whether you operate in the spot market or the market of futures and options. Contracts in the latter are subject to IRC Internal Revenue Service Section This means they are taxed based on the simple 60 to 40 rule.

The rest of the profit is regarded as money from short-term activities. Therefore, this system is preferred by large-volume Forex traders. Traders who buy and sell currency in the spot market may choose to be classified as either or traders, forex taxes. Most participants in spot Forex trading on the OTC market choose this option. Forex taxes Section regulates fx operations whose settlement is achieved in two days. Here, how much you are charged depends on how trading is classified.

If it is viewed as spread betting by an amateur speculator, it forex taxes tax-free, forex taxes. In all other cases, you need to pay tax forex taxes personal profits. It is calculated as Capital Gains Tax CGT and charged at the end of the tax year that lasts from April 6 to April 5, forex taxes.

UK traders are not charged for every single trade they execute. Instead, their overall result for the year is considered. Note that not the entire amount of capital gains is taxed. Personal income under £12, is tax-exempt, forex taxes. But how to tell if you are an amateur speculator or not? It is advisable to consult an accounting expert or the HMRC.

The legislation is quite complex. Three elements matter the most: what assets you trade, forex taxes, how this activity is interpreted, and how the entity registers your status.

There are three categories at present:. Taxation is a compulsory element of any business. Trading is no forex taxes — unless you reside in a country with a zero tax rate. These are forex taxes most attractive geographic spots in terms of tax treatment.

Their residents do not have to pay any Forex trading tax, think about capital gains, calculate income tax, etc. These places are also known as spread betting tax-free countries. In the Bahamas, no personal income is subject to taxation in general. The government receives sufficient revenue from its travel industry and different offshore activities. This forex taxes the only country with an Arab population that has zero taxes on personal income and corporate profits.

This picturesque island in the country of Borneo has perfect banking conditions, as well as tax-free trading. This is a part of the British Overseas Territory located near the Bahamas. This place is where many talented entrepreneurs reside. Businessmen acquire residency to circumvent the higher tax rate in their countries. This is a Middle Eastern state where personal income is not taxed. It is difficult to get a resident permit, though — you can only do it through a family member or by getting employed by a local company.

The country is a well-established offshore financial center. It is important to note that this list may change in the future, forex taxes, as local regulations are also changeable. The countries listed above also offer tax-free conditions for businesses. Beginners need to learn about common ways to make a profit on Forex.

Inexperienced traders are advised to start small regardless of their desire to earn a lot, forex taxes. The way you protect what you have is just as important as the profit you gain. Citizens of certain countries have the luxury of lax tax treatment.

For them, this activity is less complex, as they do not have to deal with formalities, forex taxes. Elsewhere, traders need to be aware of any tax rate applicable to their capital gains to comply with the law. Find out as much as possible about conditions for long-term capital and short-term capital gains. If this is the case, and you are serious about pursuing an FX career, do your homework. Freddie North. Forex taxes Adamson.

Please log in again. The login page will open in a new tab, forex taxes. After logging in you can close it and return to this page. If you need help click here, forex taxes. Share 0. Tweet 0. How is Forex Trading Taxed. Forex taxes by: Kelly AdamsonMarch 3, Updated: March 10, forex taxes, Reading Time: minutes.

Parts of How is Forex Trading Taxed. Forex taxes Is the Tax Percentage on Forex Trading? Example: the US Tax System The US has a stringent system of regulations. Example: The UK Tax System Here, how much you are charged depends on how trading is classified. There are three categories at present: Speculative Forex trading is similar to betting, forex taxes. No capital forex taxes to calculate and no taxes to pay, but you cannot claim losses either. Self-employed traders forex taxes to pay Forex trading tax in the form of business tax for any self-employed professionals, so the size of capital gains matters.

Check what losses can be claimed in your case. Private investors are obliged to forex taxes Capital Gains Tax CGT, forex taxes. Countries Where Forex Trading Is Tax-Free Taxation is a compulsory element of any business, forex taxes. The Bahamas In the Bahamas, no personal income is subject to taxation in general.

United Arab Emirates This is the only country with an Arab population that has zero taxes on personal income and corporate profits. Brunei This picturesque island in the country forex taxes Borneo has perfect banking conditions, as well as tax-free trading.

Monaco This small EU country does not impose income tax on residents. Turks and Caicos This is a part of the British Overseas Territory located near the Bahamas. The British Virgin Islands This place is where many talented entrepreneurs reside. Oman This is a Middle Eastern state where personal income is not taxed. How to Make Higher Profit Beginners need to learn about common ways to make a profit on Forex.

Forex taxes Bottom Line Citizens of certain countries have the luxury of lax tax treatment. Click to rate this post! Related Posts, forex taxes. Close dialog. Session expired Please log in again. Please wait while you are redirected to the right page Please share your location to continue. English Indonesian, forex taxes.

How Do Forex Traders Pay Taxes? - (MUST WATCH)

, time: 11:41Do I Pay Tax on Forex Trading in the UK?

3/3/ · Speculative Forex trading is similar to betting. No capital gains to calculate and no taxes to pay, but you cannot claim losses either. Self-employed traders have to pay Forex trading tax in the form of business tax for any self-employed professionals, so the size of capital gains matters. Check what losses can be claimed in your case/5(4) 8/22/ · Certainly, a 12% tax rate reduction is worthwhile to pursue for all currency traders. Cash forex is subject to IRC § (treatment of certain foreign currency transactions) The principal intention of IRC § is taxation on foreign currency transactions in a 3/29/ · Forex traders found liable to personal taxation on their trading profits in the U.K. are taxed on the basis of their applicable income tax rates or capital gains tax. Interest payments and profits from trading when conducted as a business are likely to be subject to income tax (from 20% to 45%), while other taxable profits are generally taxed as a capital gain (at 10% or 20%).Estimated Reading Time: 3 mins

No comments:

Post a Comment