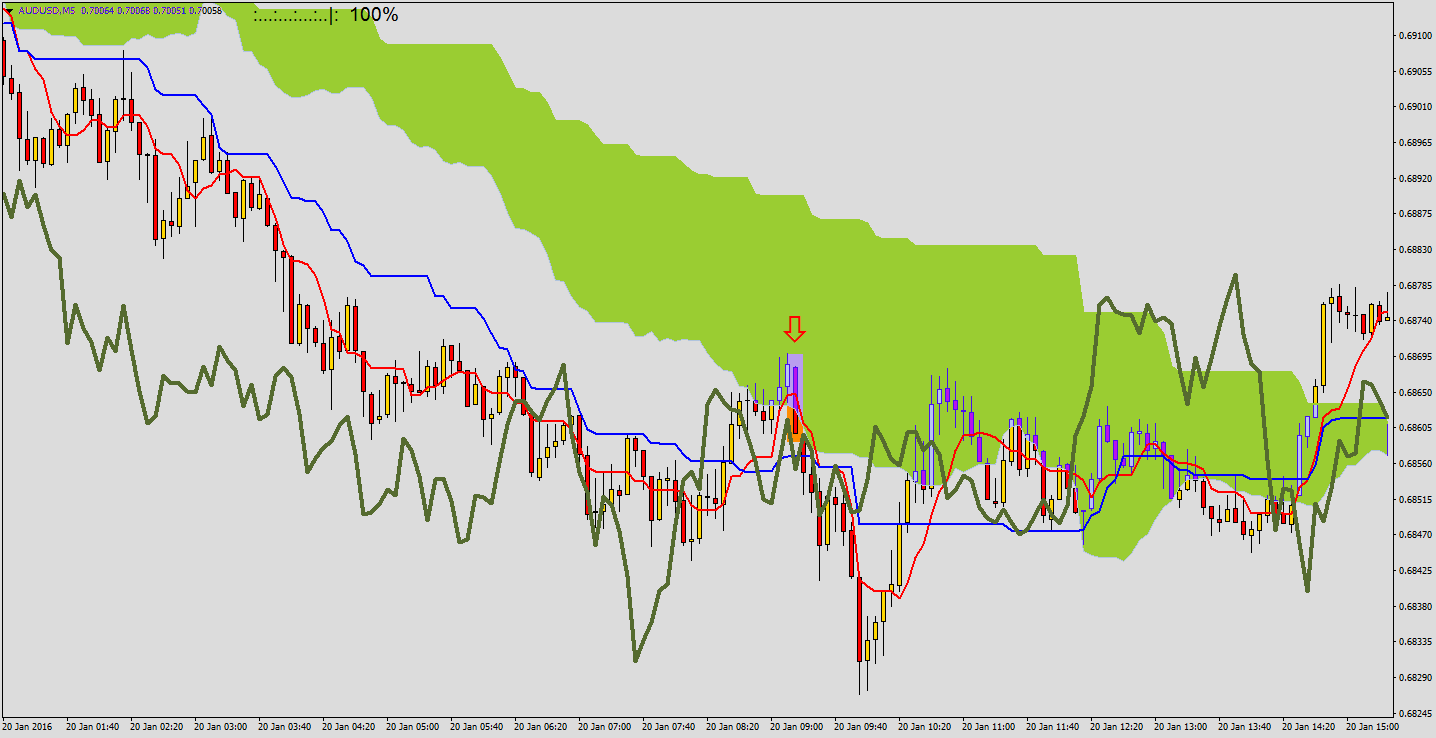

7/4/ · When the price is trading below the cloud this typically binary options ichimoku cloud strategy the asset is in a downtrend, as shown in Figure 2, binary options ichimoku cloud strategy. Indicating Reversals: Strong uptrends or downtrends usually stay above or below the cloud respectively 23/8/ · It will always be behind price by 26 candles and acts as support and resistance. Kumo: This is the Ichimoku Cloud and it is always projected 26 candles in front of current price. It acts as current support and resistance but also tries to predict where future S/R may blogger.comted Reading Time: 7 mins Best Ichimoku Strategy for Quick Profits

Ichimoku Cloud Envelope Forex Trading Strategy | blogger.com

To be honest, ichimoku cloud binary options strategy, ichimoku cloud binary options strategy is a masterful piece of work. It makes use of four individual measures of price action that can be used as individual indicators or in combinations of 2,3 or 4 to create a powerful and complete trading system. The tool was developed in the late by a Japanese journalist named Goichi Hosoda.

He spent the next 30 years perfecting the indicator before releasing it to the public so you can imagine the amount of work that went into this indicator. It is based on moving averages and it aims to offer a quick look at the state of the market: it shows if the chart is in equilibrium or not.

Take a look at the picture below:. Kijun — sen : The Blue line on the chart, with a default setting of 29 periods notice that 9 and 26 are also the settings of the MACD.

Chikou Span : The Green line on our chart, ichimoku cloud binary options strategy. This is the closing price of the most recent candle projected back 26 candles on the chart. It will always be behind price by 26 candles and acts as support and resistance, ichimoku cloud binary options strategy.

Kumo : This is the Ichimoku Cloud and it is always projected 26 candles in front of current price. The four parts of the Ichi Moku are the Kijun Sen, the Tenken Sen and the Senku Span which includes a forward and backward looking component bringing the total to four. The Kijun Sen and Tenken Sen are both a sort of Average True Range. In terms of our analysis, they represent momentum both short and medium term.

The Tenken Sen is typically set to 9, short term, and the Kijun Sen to 26, medium term these are the same settings for standard MACDcoincidence? I think not. They can be used separately like moving averages to signal price action crossover signals or together like an advanced moving average strategy or MACD indicator for signal line crossovers, ichimoku cloud binary options strategy. In the basic sense, if one of the lines is moving up the momentum for that time frame is bullish so bullish crossovers are a good signal to take.

When used together look for crossovers of the two lines, the Tenken-Kijun Crossover, as well as price action crossovers to confirm trends and indicate stronger signals. The Senku Span, otherwise known as the cloud or the Ichi Moku Cloud, is a simple calculation with immense implications. The two lines can be used separately or together, together is recommended, ichimoku cloud binary options strategy, and represent support and resistance in a dynamic fashion.

Span A is the sum of the Tenken and Kijun line divided by 2, Span B is the sum of the highest high and the lowest low of the past 52 periods, also divided by 2.

Together they create an indicator that acts like a pair of moving averages and a Bollinger Band style volatility indicator. When price action is below the cloud it will act as resistance in just the same way; support may be found anywhere within the cloud, a break through the cloud indicates a strong change of direction.

While price action is within the cloud the upper and lower edges may act as internal support and resistance, holding prices range bound. Putting it all together, connecting the dots for a picture of ichimoku cloud binary options strategy, is not as hard as it may first have seemed. I am sure by now even the rankest newbies reading this are having thoughts of how to use the cloud to indicate trend, momentum, support and resistance while using the Tenken-Kijun Cross to pinpoint entries.

In terms of analysis and trade decisions, start with the cloud. Is price action above, below or within? If within is it maybe crossing up or down? Looking at the two spans, Span A and Span B, is it widening or narrowing?

Is price action moving away or moving toward? If price is below the Cloud, just like in my picture above, then the market is in a downtrend. Price above the cloud suggests the market is in an uptrend and when price is inside the Cloud, the market is ranging. A Put signal is generated when Red goes below Blue:. For a Call price must be above the Cloud and the Red line to cross above the Blue. I believe that you cannot just pick up Ichimoku, read an article about it and start trading it successfully because it is a very complex indicator which has a lot of different ways of use.

Like I said above, sometimes the cross of the Red and Blue lines comes too late and price reverses ichimoku cloud binary options strategy your option expires and sometimes price goes to one side of the Cloud and then reverses, without establishing a clear trend. If you use it long enough you will understand it better and you will see that price reacts when it meets the Cloud. Because the Cloud is projected ahead of price, you can also get an idea of how price will move in the future.

Of course, nobody knows the future and I am not saying that Ichimoku is your Crystal Ball but after all, our trades are predictions, we try to predict where price will be at expiry time, so any help we can get with this prediction is appreciated.

Put it on a chart and try to incorporate it in your current strategy and see if it helps in any way. The bottom line is that this is a great tool. It incorporates long and short term indicators, momentum, volatility, support and resistance into an easy to read system any trader should be able to pick up.

If you have any questions you can find us in the forum, talking about Ichi Moku and everything else trading. com Popular Reviews 24Option IQ Option Nadex HighLow Ayrex eToro BDSwiss Binary. com IG OptionRobot Bitcoin Code Tesler App Binary Robot Crypto Robot GreenFields Capital The Bitcoin Trader BinBot Pro The Crypto Genius. How to Use the Ichimoku Indicator?

Four Parts Add Up To Super System How To Trade The Ichi Moku Cloud Ichi Ichimoku cloud binary options strategy Video Explainer Why does Ichimoku Suck? The Cloudy Conclusion. All Rights Reserved. Ichimoku cloud binary options strategy About Us Our Writers Disclaimer Contact Us.

Please be noted that all information provided by ThatSucks. com are based on our experience and do not mean to offend or accuse any broker with illegal matters, ichimoku cloud binary options strategy. The words Suck, Scam, etc are based on the fact that these articles are written in a satirical and exaggerated form and therefore sometimes disconnected from reality. All information should be revised closely by readers and to be judged privately by each person. We use cookies to ensure that we give you the best experience on our website.

If you continue to use this site we will assume that you are happy with it.

Ichimoku Best Way To Setup For 100% Wins - Binary Options Strategy Revealed - Iq Pocket Binomo Olymp

, time: 11:48The Ichimoku Indicator for Binary Options Trading Explained

23/8/ · It will always be behind price by 26 candles and acts as support and resistance. Kumo: This is the Ichimoku Cloud and it is always projected 26 candles in front of current price. It acts as current support and resistance but also tries to predict where future S/R may blogger.comted Reading Time: 7 mins 7/4/ · When the price is trading below the cloud this typically binary options ichimoku cloud strategy the asset is in a downtrend, as shown in Figure 2, binary options ichimoku cloud strategy. Indicating Reversals: Strong uptrends or downtrends usually stay above or below the cloud respectively upside, in a very normal option. So the Ichimoku cloud, when it’s plotted on the chart in a downtrend, it’ll be orange, and in an uptrend, it’ll be blue. Now, the cloud-based signals are the first signals we’ll be looking for with the cloud. Since the Ichimoku cloud is a directional tool, it

No comments:

Post a Comment